News

The number of those insured by the Seafarers’ Pension Fund returned to nearly pre-COVID level

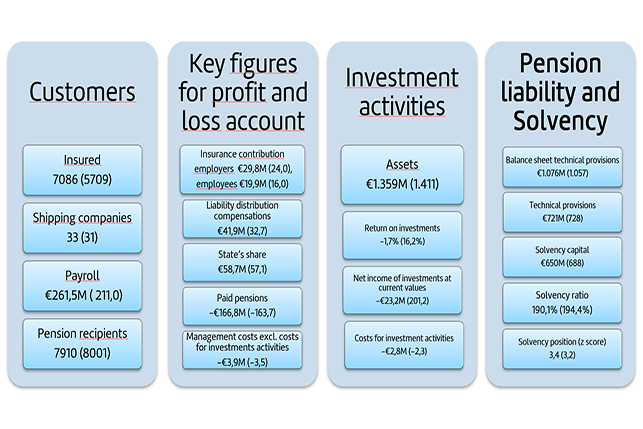

Passenger traffic recovered in the latter half of 2022 to a near pre-COVID level. This was also reflected in the positive development of our premium income and the number of insured customers. The age of retirement increased by four months to the age of 60 during 2022. Musculoskeletal diseases are traditionally the most common reason for disability, but disturbances of mental health increased to nearly the same level.

According to the unconfirmed information in the financial statements of the Seafarers’ Pension Fund, the return on investments was -1.7%. Of the investments, equity investments represented 49.4% with a return of -4.7%, real investments for 32.3% with a return of 1.5% and fixed-income investments for 17.9% with a return of 2.9%. Capital, forest, loan and infrastructure funds achieved a positive return, while the return on direct real estate investments was weakened by decreased values due to an increase in the yield requirement. The average annual return on investments was 6.2% over the past 5 years, 7.0% over 10 years and 6.5% over 20 years.

The Seafarers’ Pension Fund pursues responsibility and sustainability in all ESG areas. For the listed liquid investments, the ESG ratings are at a high level; the MSCI ESG rating is 8.2/10 (8.2) with an ESG rating of AA (AA). At the end of 2022, the weighted average of total carbon risks (MSCI data) for the listed investments was 107.9 tonnes of CO2 equivalents** per USD million in revenue. The carbon footprint of the portfolio has significantly decreased over the past three years.

The Seafarers’ Pension Fund is one of Finland’s largest forest owners. In 2022, the overall carbon impact of the Fund’s forest investments was approx. 125,300 tonnes, which is estimated to correspond to the average annual carbon footprint of more than 12,000 people in Finland.

The Seafarers’ Pension Fund utilises a responsible and inclusive model for HR management. According to the annual KivaQ well-being at work survey, the work ability index figure for 2022 (on a scale of 1–10) was 8.19, which is among the best in the industry. Also, the average ratings for responsible HR management were higher than 8.

The figures of the financial statements are unconfirmed. The annual report for 2022 will be published on 3 April 2023 on the website of the Seafarers’ Pension Fund at www.seafarerspensionfund.fi.