News

International comparison: real return of Seafarers' Pension Fund on excellent level

Link to the information leaflet of the Finnish Centre for Pensions (ETK)

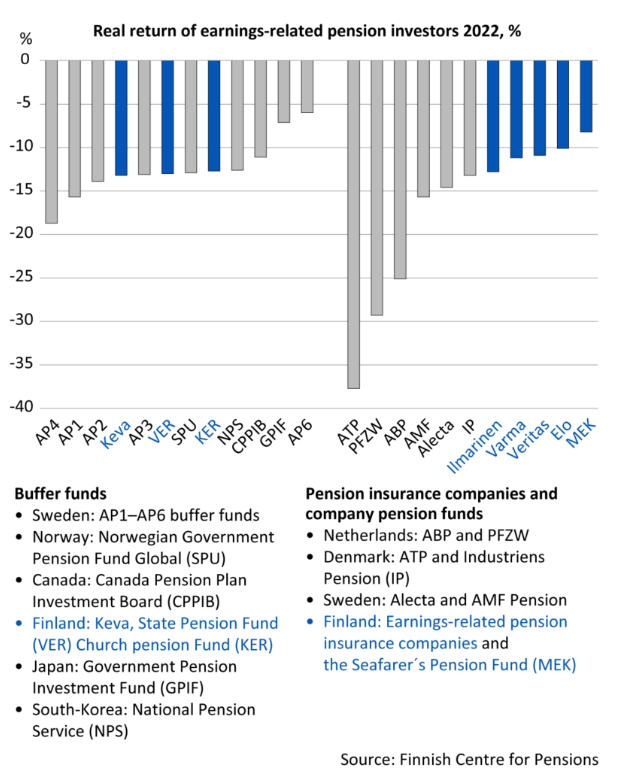

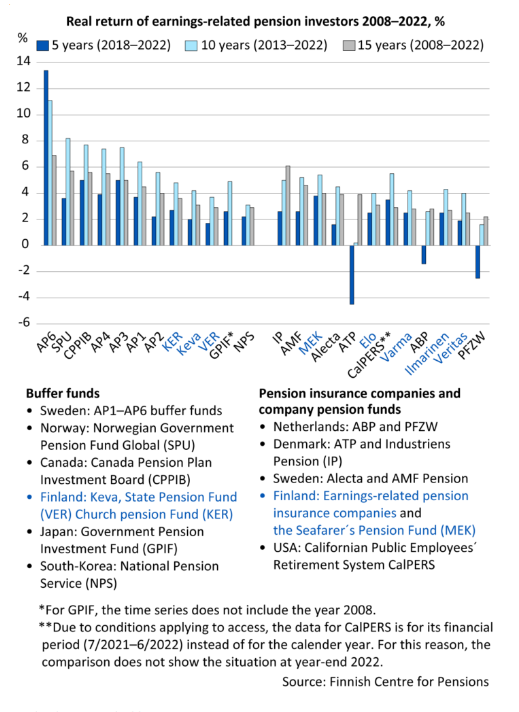

The successful long-term investment strategy of the Seafarers’ Pension Fund has led to a situation in which its 5-year real return was the highest among the 12 pension insurance investors included in the study conducted by the Finnish Centre for Pensions (ETK). The study investigated Finnish pension insurance companies as well as Swedish, Danish and Dutch pension insurance investors and one American pension insurance investor. Furthermore, the Seafarers’ Pension Fund had the highest annual return for the periods of 10 and 15 years, when compared to other Finnish pension insurance companies, the Church Pension Fund, Keva and the State Pension Fund of Finland.

The most crucial factor in terms of the good income development is the building of a so-called private asset fund portfolio, which was initiated already in the early 2000s. Commitments have been made in capital investments, loan, forest, infrastructure and real estate investments, and their share of all investments is over 40%. After the initial building phase of the portfolio, the income development of the private asset funds has been on a particularly high level. During the last 10 years, for example, the annual return has been approximately 10% (7% for the entire portfolio).

Another factor, especially last year, was the fact that the Seafarers’ Pension Fund had no bond investments, the return of which was even lower than that of listed shares. We have been reducing the weight of direct real estate investments since the year 2020, and this year we utilised the increased interest rates and risk premiums to further build the bond investment portfolio. This is one example of the role of the strategic allocation, updated annually in the investment plan, as a source of excess earnings. Also, last year we had exceptionally many opportunities to increase the weight of listed shares towards the targeted allocation, which brought significant additional return.

In our review of operations for the year 2022, we warned that the short-term return development of illiquid investments (private asset funds and direct real estate investments) may be weaker than normal as their valuations are updated with a delay. For now, it seems, however, that the effects have been less significant than what was expected. Real estate investments are associated with the most uncertainty; the values of these investments will be reduced, in addition to the decreased net return, by the increasing return requirements. We estimate that these effects will be seen, at the latest, next autumn. Their share has, however, been decreased during the last three years by 12 percentage points, and with the current weight of 17%, the effects on the entire portfolio level are minor.

Thanks to the excess earnings from our investments, our solvency has increased to an excellent level and we are able to invest in a profitable manner. Furthermore, we can operate in a very counter-cyclical manner and increase the risk level of the portfolio in market stress situations, as we did last year. We see this as a significant factor in terms of future returns. Our return in the beginning of the year has been clearly positive, and the best return has been achieved from listed equity and fixed-income investments.