News

Focusing on improving the customer experience and aspects of responsibility

In 2023, the number of insured persons and amount of the premium income increased from the previous year. The positive development was particularly affected by the addition of Viking XPRS and the new Finnlines vessels sailing under the Finnish flag. The high volume of passengers in the passenger ship sector also increased the need for personnel. In mid-February 2024, Finnlines’ second new hybrid cargo-passenger vessel began sailing the Naantali-Kapellskär route and the refitted Cinderella is set to be reintroduced in March 2024 along the Helsinki-Stockholm route, both under the Finnish flag. The outlooks for growth in premium income and passenger volumes in 2024 are promising.

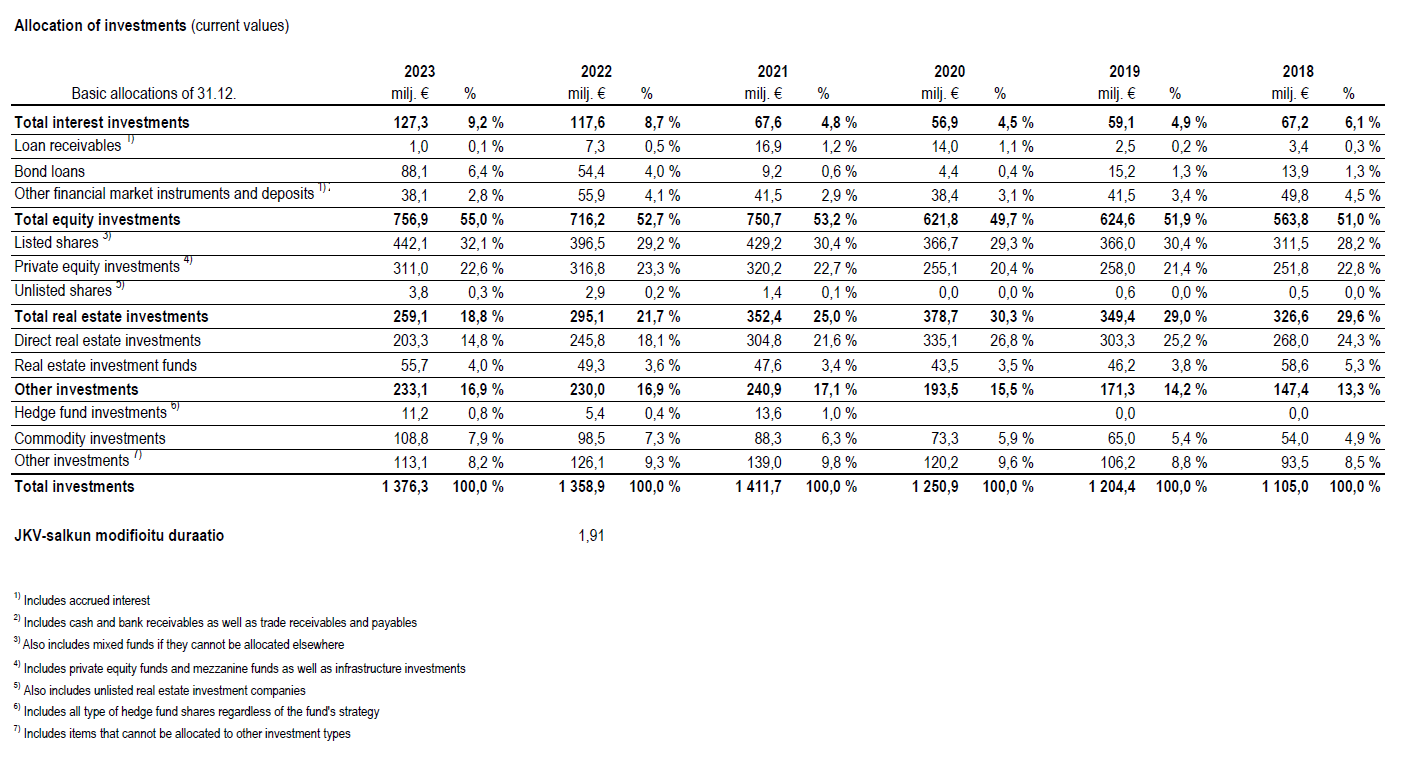

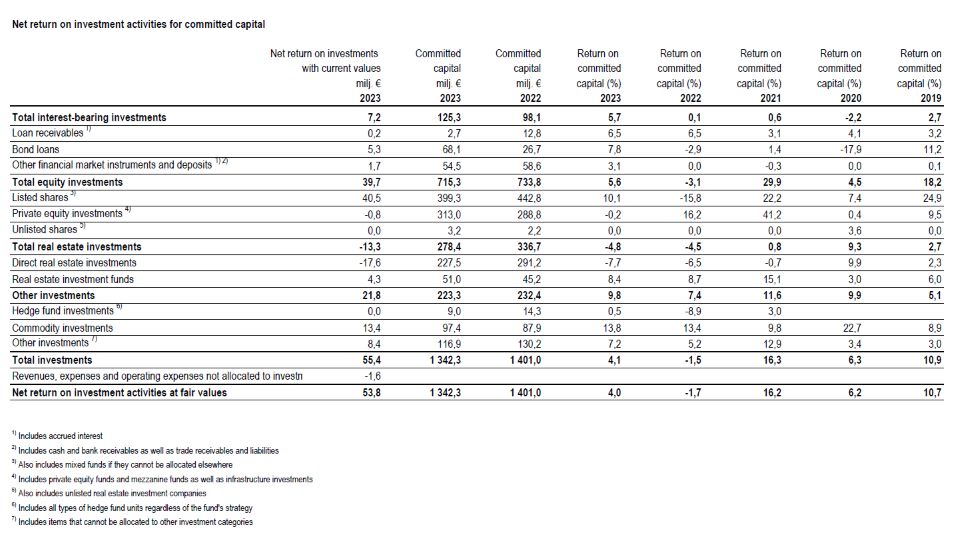

According to the unconfirmed information in the financial statements for 2023, the return on investments was 4.0%. The market value of the investments increased and was EUR 1,376 million at the end of 2023. During 2023, the Seafarers’ Pension Fund continued to realise its long-term investment strategy, the goal of which is to shift the focus of investments from real estate to liquid investments. Last year’s decline in returns with regard to the sector average was predicted already in 2022, since it was known that the return on illiquid investments would react with a delay to the increase in interest rates. The biggest reason for the lower returns was attributed to the value adjustments to direct real estate investments. Despite the fact that the return in 2023 was lower than the industry average, the investment horizon in the pension sector is long and excess earnings remain the target for the long term.

The solvency ratio of the Fund continues to be at an extremely strong level, 185.8%, while the average for earnings-related pension companies is 126.4%. The balance sheet technical provisions grew to EUR 1,097.8 million.

The number of pension applications decreased somewhat from the exceptionally high level experienced in 2022. The percentage of rejected applications increased from the previous year, as it did in the pension sector in general. The Fund’s decisions were in keeping with the general policy of the earning-related pension sector and the number of appeals was minimal. Musculoskeletal diseases remain the most common reason for disability pension in the maritime sector. The development of our vocational rehabilitation activities will continue during 2024. The average retirement age with pension was 59.5 years and, with old-age pension, 61.8 years. The customer satisfaction of pension recipients is continuously surveyed by the Fund, and the results have consistently been at an excellent level.

Responsibility and sustainability are essential aspects of our strategy. The ESG rating for our investments is AA and we have now completed our first UNPRI report. During 2023, we halved the size of the facilities utilised by the Fund, which significantly reduced the carbon footprint of our operations. Our intention is to continue to advance the responsibility targets set in 2023 as well as our selection of UN Sustainable Development Goals.

At the end of 2023, the Fund began building its AI strategy, with the aim of improving our customer and employee experience as well as our overall activities. We increasingly encourage our customers to handle their insurance matters using our online service. The number of those who have chosen to handle matters electronically in the Loki online service increased to 3,412 persons (2022:2,681) and the popularity of handling matters in the online service continues to increase. The digitalisation of services is also an act of responsibility and sustainability that enables us to reduce the overall need for paper.

We will continue to invest in the well-being of seafarers throughout 2024. Joining the International Seafarers' Welfare and Assistance Network (ISWAN) offers the Fund access to international research information and tools. At the end of 2023, we also become an Observer Member of PensionsEurope, which is an organisation that advances the monitoring of increasing regulations within Europe. We are participating in a joint pension sector information system reform project concerning pension calculation and insurance during 2024-2027, and we will continue our long-term preparedness for changes in the pension system also as they impact our investment activities.