News

Our Pension Contribution Income Reached a New Milestone

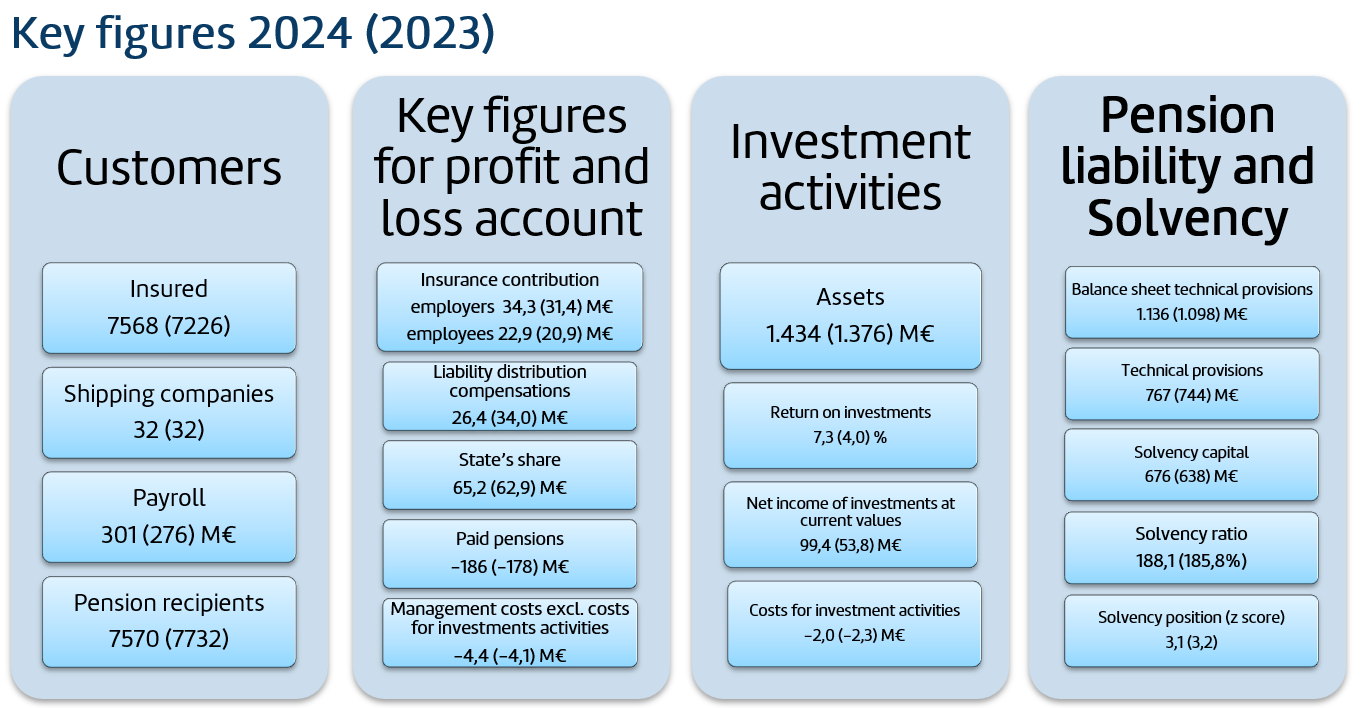

In 2024, the number of insured persons increased to 7,568 (7,226), and the total payroll rose by 8.8 percent, exceeding 300 million euros. Newly reflagged vessels under the Finnish flag contributed to increased travel activity, leading to the share of passenger shipping rising to 53.9 percent of the total payroll.

According to preliminary financial statements for 2024, investment returns reached 7.3 percent, and the market value of investments grew to 1,434 million euros. We continued increasing the proportion of liquid investments, which stood at 47.2 percent. The highest returns were generated from forest investments as well as listed equity and fixed-income investments. In contrast, real estate investments remained slightly negative in terms of returns. The share of real estate in the portfolio has now been halved compared to 2020.

The solvency ratio of the Seafarers’ Pension Fund remains very strong at 188.1 percent, while the average solvency ratio of earnings-related pension companies is estimated at 129.2 percent.

The number of pension applications declined, as the low index adjustment for earnings-related pensions did not result in the usual spike in applications in December. The number of pension recipients decreased to 7,570 (7,732). At the same time, the number of rejections increased. A similar trend has been observed across the entire earnings-related pension sector, as more people are applying for disability pensions.

We continued our sustainability efforts, and the carbon risk of our listed investments decreased by one-third compared to the previous year. We also launched energy efficiency renovations in two of our properties. In other areas, we have introduced new initiatives to promote seafarers’ occupational well-being. These measures will be implemented during 2025. The efforts to enhance seafarers’ work ability are based on the Seafarers’ Pension Fund’s registry data and research findings.

Our AI strategy was completed in early 2024, and implementation has progressed well across multiple areas, including communications, the development of a closed and secure data platform, and the introduction of new digital tools for employees. As part of our digital transition, we have decided that out of the four annual issues of Albatrossi, only two will continue to be published in print.

We are developing new collaboration models to promote seafarers’ occupational well-being, with the aim of better supporting shipping companies in assessing and managing the risk of work disability. We are also prepared for the share of equities in our investment portfolio to continue increasing as a result of the reform of the earnings-related pension system’s investment regulations.